Time is Money...

Saving Early just might ease the burden of saving enough

- Starting early allows you to get the greatest benefit from tax deferral and compounding.

- When you invest your money in a tax-deferred account you can experience tax-deferred growth. This means you don't pay tax on any gains associated with your account until the time you withdrawal it.

- Additionally, any gains on that money are reinvested, earning you even more. This is known as compounding.

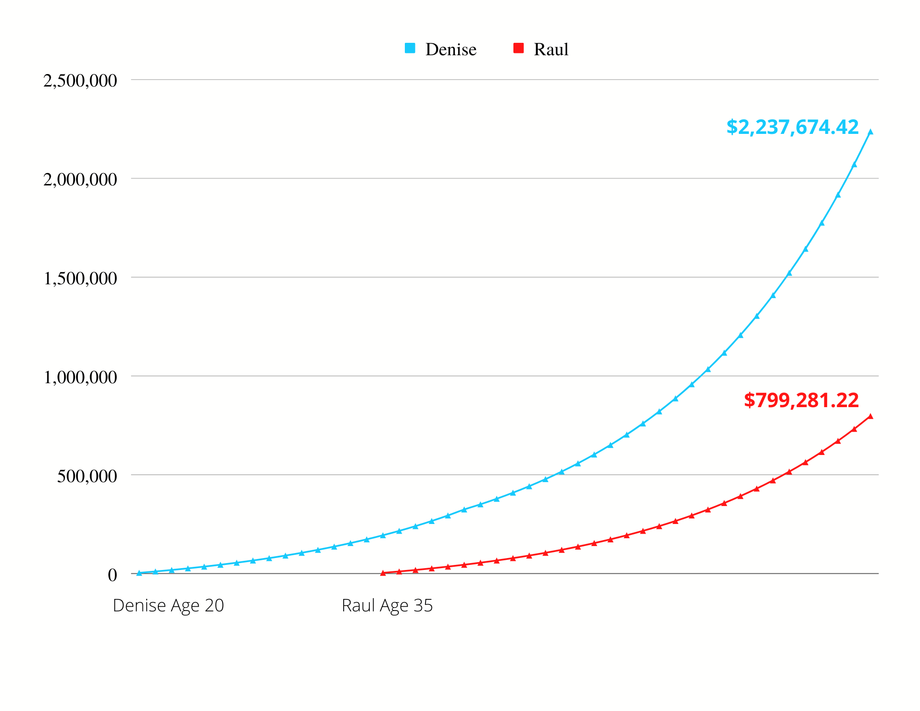

In the model below, Denise started contributing at age 20, and contributed for a total of 20 years. At age 40 she decided to let the investment ride and contributed no more money to the account, her total contributions totaled $120,000. Based on a $6,000 annual contribution and an 8% rate-of-return her total investement grew to $2.37 milion! On the flip side, Raul waits and starts to contribute at age 35, and he contributes until the age of 65, when he retires. He contributed for 30 years and his total contribution equals $180,000. This illustrates what we like to call, the cost of delay.

*For Illustration purposes.

*Based on an annual $6,000 Max IRA contribution, and an 8% average ROR each year.

*Our example is hypothectical. Your experience may be different, and while tax deferral and compounding interest can have appositive long-term impact on your account balance, there may still be periods of time when it doesn't grow. In our example we assume an annual 8% rate of return and no withdrawals from the account until retirement. Withdrawals of earnings would be subject to ordinary income tax, and if you tak emoeny from the account prior to age 59 1/2, you may incur an additional 10% IRS penalty.

This material was created by professionals at Pricnipal® and is being used with permission. (DBA/reps with DBA) did not create and are not owners of this material.

This subject matter in this communication is provided with the understanding that Principal® and Sanfillipo Financial are not rendering legal, accoutning or tax advice. You should consult with appropriate councel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements. 2079789-032022